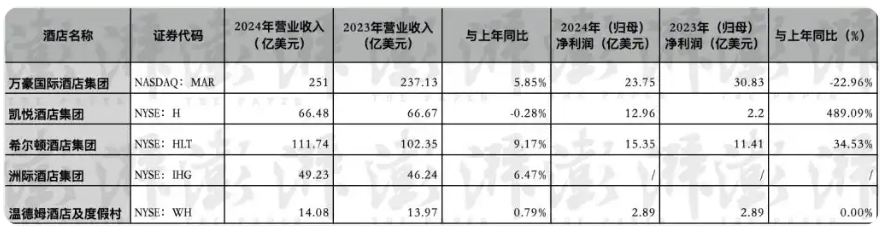

Recently, several foreign-funded hotel groups have disclosed their 2024 performance reports. Financial data shows that throughout 2024, only Hilton Worldwide Holdings Inc. (NYSE: HLT, hereinafter referred to as "Hilton") recorded year-on-year growth in both operating revenue and net profit. Among them, the operating revenue increased by 9.17% year-on-year, and the net profit attributable to the parent company increased by 34.53% year-on-year.

Marriott International, Inc. (Nasdaq: MAR, hereinafter referred to as "Marriott") saw its operating revenue increase by 5.85% year-on-year, while its net profit decreased by 22.96% year-on-year. Hyatt Hotels Corporation (NYSE: H, hereinafter referred to as "Hyatt") experienced a 0.28% year-on-year decrease in operating revenue, but the net profit attributable to the parent company increased by 489.09% year-on-year. WYNDHAM HOTELS & RESORTS (NYSE: WH, hereinafter referred to as "Wyndham") saw its operating revenue increase by 0.79% year-on-year, and its net profit remained the same as the previous year.

InterContinental Hotels Group PLC (NYSE: IHG, hereinafter referred to as "InterContinental Hotels") saw its total revenue increase by 0.79% year-on-year. The Paper noticed that the significant year-on-year increase in Hyatt's net profit in 2024 was mainly due to a gain of $1.245 billion from real estate sales and other revenues. In the same period last year, the revenue from this item was only $18 million. In addition, the financial report data disclosed by InterContinental Hotels Group shows that in 2024, the revenue of the reportable segments of InterContinental Hotels was approximately $2.312 billion, an increase of 7% year-on-year; the revenue from the fee business was approximately $1.774 billion, an increase of 6% year-on-year; the operating profit was approximately $1.124 billion, an increase of 10% year-on-year; and the adjusted earnings per share increased by 15% year-on-year.

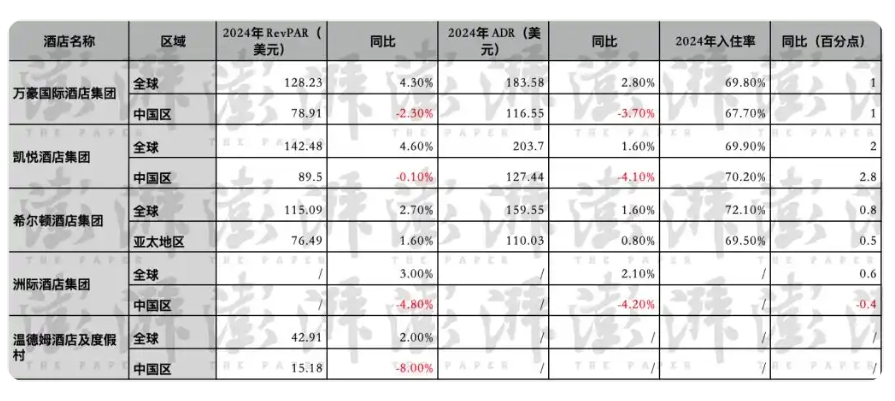

Judging from the indicator data of the accommodation industry, the overall RevPAR (Revenue per Available Room), ADR (Average Daily Rate), and occupancy rate of the global hotels under the above-mentioned foreign-funded hotel groups all recorded year-on-year growth. Among them, the overall RevPAR of Marriott and Hyatt's global hotels increased by more than 4% in 2024. In the fourth quarter of last year, the overall RevPAR of Marriott and Hyatt's global hotels increased by 5%.

"In the fourth quarter of last year, thanks to the double increase in the Average Daily Rate (ADR) and the occupancy rate, the global RevPAR increased by 5%. The RevPAR in the international market increased by more than 7%. Driven by strong leisure demand, the Asia-Pacific region and the Europe, Middle East and Africa (EMEA) region performed outstandingly.

The RevPAR in the United States and Canada increased by more than 4%, which is the highest RevPAR growth rate in the region throughout the year, and all customer groups have increased compared with the same period last year," Anthony Capuano, CEO of Marriott, pointed out in the performance report. It is worth noting that when viewed by region, the RevPAR of Marriott, Hyatt, InterContinental, and Wyndham's hotels in China all recorded year-on-year decreases in 2024. Among them, the RevPAR of Wyndham's hotels in China decreased by 8% year-on-year; the RevPAR of Marriott, Hyatt, and InterContinental's hotels in China decreased by 2.3%, 0.1%, and 4.8% respectively year-on-year.

Although Hilton did not disclose the accommodation industry indicator data of its hotels in China separately, judging from the data of the Asia-Pacific region it disclosed, the RevPAR of hotels in the Asia-Pacific region increased by 1.6% year-on-year in 2024, which was the lowest growth rate among all regions.

In terms of the average daily rate, the ADR of Marriott, Hyatt, and InterContinental's hotels in China decreased by 3.7%, 4.1%, and 4.2% respectively year-on-year.

However, in 2024, the number of hotels of many foreign-funded hotel groups in China grew satisfactorily. On February 19, Marriott announced that the performance of the group's hotels in China grew strongly in 2024: a total of 161 projects were signed throughout the year, with nearly 31,000 guest rooms. On average, more than 3 projects were signed per week, and the signing volume reached a record high.

Among them, the luxury brand showed strong momentum, with the number of signed guest rooms increasing by 73% year-on-year in 2024.

As of the end of 2024, 285 hotels were in operation in the high-end brand segment, and another 151 hotels were under construction; more than 30 new projects were signed in 2024, an increase of 88% year-on-year, and entered 7 new destinations.

In addition, in the projects signed by Marriott in the Greater China region in 2024, more than 75% were select service brand hotels, and the signing volume increased by 60% year-on-year.

Mao Yibing, a member of the Global Executive Committee of Marriott International and President of Greater China, said: "In 2024, Marriott International fully accelerated its development in the Greater China region... The vigorous development fully confirms that the group's '3+2+1' strategy, which takes diversified brands, loyal member communities, and destination matrices as growth engines, is precisely in line with the Chinese market.

In the future, we will further enrich the depth and breadth of our product portfolio, create excellent experiences for guests at home and abroad, and create value for our partners." Elie Maalouf, CEO of InterContinental Hotels Group, also said: "The acceleration of the revenue per available room globally in the fourth quarter reflects that our footprint spans the three global markets and we still maintain continuous expansion. Currently, the global assets of InterContinental Hotels Group have exceeded 6,600 hotels.

We will maintain this growth momentum in 2025, and the opening of our 800th hotel in the Greater China region at the beginning of this year is the best proof. The number of hotels under construction globally is more than 2,200, an increase of 10% year-on-year, which demonstrates that the future system scale will achieve a 33% growth." Content source: The Paper. If there is any infringement, please contact 19946259075 to delete it.